Fraud. It’s something every business fears. While the tactics and tools they use may change over time, fraudsters are an ever-present threat to organisations of every size. The prevention and early detection of fraud can be the difference between success, survival and insolvency.

As too many know, discovering fraud at the hands of a trusted insider can be devastating – on a number of levels. Fortunately, experts in investigating ‘occupational fraud’ are providing us with evidence-based insights to direct our anti-fraud efforts.

Invest a few minutes in this 2024 update of our previous analysis of how fraud is detected – and then reflect on whether you are allocating adequate resources to the service that is, unarguably, your greatest ally in the detection of fraud in your organisation.

Unarguably? Yes. The results are unequivocal, and better yet, they have been replicated repeatedly, strengthening what researchers call their ‘validity’. They also have strong applicability across geographic regions, thanks to the Certified Fraud Examiners, specialists in detecting, investigating and resolving fraud cases, who contribute in-depth data from organisations around the globe to the biennial research undertaken by the Association of Certified Fraud Examiners.

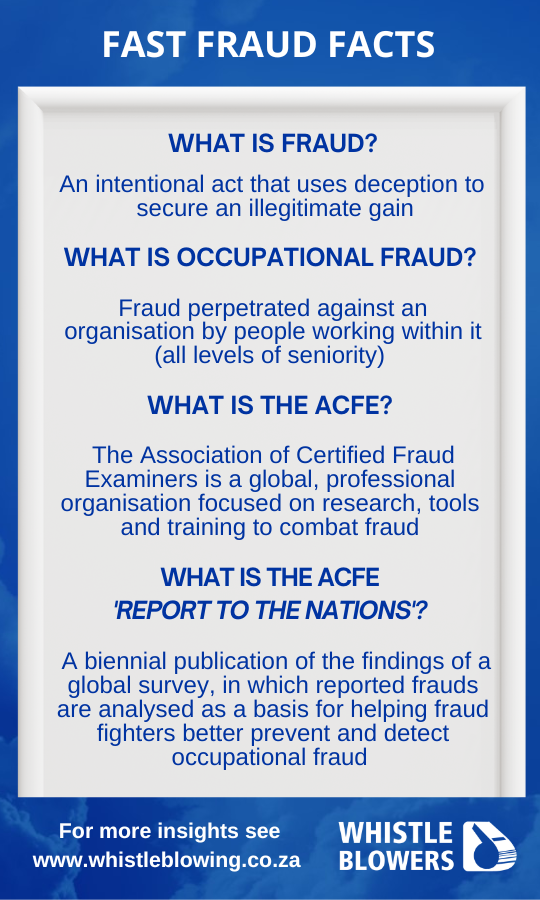

Not a fraud fundi? Don’t know the ACFE? Read our Fast Fraud Facts box first!

What is the most effective method by which fraud is detected?

Let’s get to the crux of the matter. The 2024 ACFE report again showed that the most effective method by which fraud was detected was this:

Information offered to the organisation by people seeking to report suspicions or knowledge of wrongdoing.

Referred to as ‘tips’ in the report, this source of intelligence is three times more effective than even the second most effective source – internal audit. To be specific, tips were found to be the source of initial detection in 43% of fraud cases, compared to:

Internal audit (14%) | Management review (13%) | Document examination (6%) By accident (5%) | Account reconciliations (5%) | External audit (3%) | Automated transaction & data monitoring (3%) | Surveillance (2%) | Advised by law enforcement (2%) | Other 2% | Confession (1%)

Wait a minute! Surely not? When you contemplate the extent of resources the average medium to large size business is devoting to activities such as internal audit, management review, account reconciliation and the like, it is hard to believe their comparative lower effectiveness in fraud detection.

It may be easier to understand when one considers that insiders are at an advantage when it comes to deceiving their employer:

- They know how to circumvent your controls, and they know about the loopholes you have unwittingly left open to exploit.

- They have knowledge and access that makes it easier for them to create fraudulent documents and alter or destroy original documents.

Little wonder then that unmasking these masters of deception can depend upon the receipt of intelligence from others who suspect or observe the fraudster’s wrongdoing.

Given that tips are clearly tops when it comes to fraud detection, let’s turn to the subject of who these people are that are volunteering this crucial information. Knowing their relationship to you will guide you when you come to communicating your whistleblowing policy and procedures.

Looking at the ACFE 2024 data, we find that 15% of tips were made anonymously, so we do not know what their relationship to the organisation was. But these are the groups that could be identified:

Employees (52%) | Customers (21%) | Suppliers (11%) | Others (7%) | Shareholders (1%) | Competitors (1%)

While employees are clearly the largest single source and deliver the majority of tips, it’s worth noting that a sizeable 41% of the total tips come from other sources. It’s no wonder that the ACFE recommends that your whistleblowing policy communication targets both internal and external audience.

What impact does a hotline have on the speed of detection and extent of loss to fraud?

It is clear from the data that two things are on the rise: the percentage of organisations who offer a hotline reporting mechanism to their stakeholders, and the percentage of tips that are received via hotlines as opposed to other reporting methods.

But what we found most illuminating are these two findings:

- At organisations with hotlines, fraud schemes were detected sooner (non-hotline organisations took 50% longer)

- Organisations without hotlines suffered double the amount of loss to fraud than did those with a hotline.

Again the ACFE data showed the vulnerability of smaller organisations to fraud. Of the various organisation size categories as measured by number of empoyees, the 100 and less employee organisations suffered greater losses to fraud than did all other categories other than the 10 000+ employee group.

As an aside, these smaller organisations (less than 100 employees) typically suffer greater losses than larger ones, in part due to the fact that they typically take far longer to detect the fraud. They are also less likely to have prioritised the investment in a hotline, not appreciating that these cost-effective services may well be even more justified where employee numbers are small.

A simple yet striking observation by the ACFE

The authors of the 2024 ACFE Report to the Nations explain that when fraud is detected proactively, it tends to be detected far more quickly and consequently results in lower losses. Conversely, passive detection results in longer running schemes and greater material loss.

Which takes us back to the various methods of detection. Many of these are undoubtedly ‘proactive’. They are practices, personnel, controls and tools that are subject to management attention on a regular, if not daily basis.

Which methods fit the ‘proactive’ description? Well, undoubtedly these would include internal audit, account reconciliation, automated transaction/data monitoring, surveillance and account reconciliation.

But does the way you manage whistleblowing in your organisation qualify as a proactive or passive method of fraud detection? Whether or not you are maximising the most effective known source of fraud detection (by far), all depends upon your approach.

A place to start

We’re sure you agree that, in light of the above findings, any steps that increase the extent to which your whistleblowing management is proactive will be worth taking!

But where to start?

How about by placing this article on your next executive team agenda and use it to raise awareness and garner support, and then task your various strategic support specialists to collaborate on the development of a draft action plan. The collective wisdom generated when your various governance, risk and compliance functions work together with your internal audit and human resources specialists is what the topic of whistleblowing calls for.

In closing, it is important to mention that the ACFE Report to the Nations contains a host of other content that will guide your fraud prevention, detection and management activities. Remember to visit the ACFE website to download this report and other free-to-use, research based resources.

Preventing and detecting fraud can be the difference between sustainability and insolvency – and the work of the ACFE means that your approach to fraud can stand upon the experienced shoulders of certified fraud examiners from around the world. Their message is clear: whistleblowing is the #1 tool for fraud detection.

This value is even greater where organisations make an ethics hotline service available, where executives and all employees receive fraud training, and where whistleblowing is managed as a proactive rather than passive fraud detection mechanism.

Regular readers of the articles published by Whistle Blowers Ethics Hotline will be familiar with the guidance we make available. For example, the following articles will provide further insights relevant to the objective of activating your organisation’s whistleblowing management:

- Valuable guidelines for the management of whistleblowing – ISO 37002

- Do’s and don’ts for encouraging employee whistleblowing – backed by science

- Anti-deterrence: The gaping hole in your whistleblowing policy?

- The merits of axe to grind whistleblowing reports

As our ethics hotline clients know, we offer fraud awareness learning content – which the ACFE Report to the Nations once again found has a significant impact on the likelihood of your people speaking up about fraud.

Based in South Africa, our service is utilised by clients around the globe, and we are specialists in the management of whistleblowing reports on behalf of clients operating throughout the African continent. For more information about our multi-channel, multilingual ethics hotline service visit our website.

Leave a Reply